Update: Proposed Delisting from the Official List of ASX – Formal Consent of ASX to Delist – Filing of Final Definitive Proxy Statement and Notice of Special Meeting

BOSTON and SYDNEY — 27 May 2020 — GI Dynamics® Inc. (ASX:GID) (“GID” or the “Company”), a medical device company that is developing EndoBarrier® for patients with type 2 diabetes and obesity, confirms that further to its announcement of 11 May 2020, the Company has applied to the Australian Securities Exchange (“ASX”) for its formal approval for the delisting of the Company from the Official List of the ASX (“Official List”) and provides the following update in relation to this and associated matters.

Delisting

Following receipt of the In-Principle Advice of the ASX as announced on 11 May 2020 (“In-Principle Advice”), the Company applied to the ASX for formal approval of the delisting of the Company from the Official List on 26 May 2020 (“Delisting”).

The Company is pleased to confirm that ASX has now provided its formal consent to the Delisting on the conditions set out in this announcement. As indicated in the In-Principle Advice, and as is its usual practice, the ASX has imposed a requirement under Listing Rule 17.11 and Guidance Note 33 “Removal of Entities from ASX Official List” for the Company to obtain stockholder approval if it wishes to delist from the Official List.

The Company confirms that ASX has imposed the following conditions on the Company in connection with the obtaining of such stockholder approval and subsequent Delisting:

- “The request for removal of GID from the official list of ASX is approved by a special resolution of shareholders of GID (which requires a vote of no less than 75% of the shares of common stock, including the underlying shares represented by CDIs, present virtually or by proxy at this Special Meeting).

- The notice of meeting seeking shareholder approval for GID’s removal from the Official List must include a statement, in form and substance satisfactory to ASX, setting out:

- a timetable of key dates, including the time and date at which GID will be removed from ASX if that approval is given; and

- that if shareholders wish to sell their shares on ASX, they will need to do so before GID is removed from the official list of ASX; and if they do not, details of the processes that will exist after GID is removed from the official list to allow a shareholder to dispose of their holdings and how they can access those processes.

- The removal shall not take place any earlier than one month after security holder approval is obtained.

- GID releases the full terms of this decision to the market upon making a formal application to ASX to remove it from the official list of ASX.”

Final Proxy Statement and Notice of Special Meeting

Further to the announcements of 11 May 2020 and 18 May 2020, the Company is proposing to seek stockholder approval for the proposed Delisting in accordance with the conditions imposed by the ASX.

A special meeting of the Company is proposed to be held on Sunday June 7, 2020, at 6:00 p.m., (United States Eastern Daylight Time, “EDT”), which is Monday June 8, 2020, at 8:00 a.m., Australian Eastern Standard Time (“AEST”) (“Special Meeting”).

Attached to this announcement is a copy of the final definitive proxy statement and notice of the Special Meeting that was filed with the SEC on Tuesday 26 May 2020, EDT (“Notice of Special Meeting”) and which has been posted to stockholders today.

As a result of the public health and travel guidance and concerns due to COVID-19, the Special Meeting will be held virtually via the online platform. Details of how to log into the platform for the meeting and, if you qualify to do so, to vote during the virtual meeting are provided in the Notice of Special Meeting.

The Notice of Special Meeting otherwise describes the business which the Company will conduct at the Special Meeting and provides information about the Company that you should consider when you vote your shares of common stock.

Stockholders are advised that the Notice of Special Meeting is a very important document.The Company encourages all stockholders to read the Notice of Special Meeting carefully.

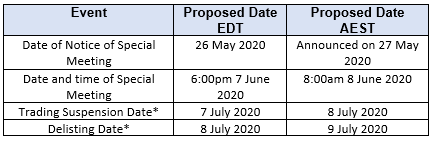

Timetable

The timetable for the Delisting is set out below.

*assumes stockholder approval for the Delisting is obtained

Reasons for Seeking the Delisting

An overview of the reasons for seeking a Delisting were detailed in the announcement of 11 May 2020 and are also set out in the attached Notice of Special Meeting.

Consequences for the Company and its security holders if the Company is removed from the Official List

In the event that stockholders approve the Delisting at the Special Meeting, the Company will be delisted from the ASX in accordance with the above timetable (and in any event on a date that is at least one month after the date on which stockholder approval for the Delisting is obtained at the Special Meeting (“Delisting Date”)). Should stockholder approval be obtained for the Delisting then the Company will be committed to the delisting process and will delist on the Delisting Date.

A more detailed overview of the consequences of a Delisting for the Company and its security holders is detailed in the announcement of 11 May 2020 and is also set out in the attached Notice of Special Meeting.

Arrangements in place to sell CDIs in the lead up to the Delisting

In the event that a Delisting occurs, stockholders that wish to sell their CDIs on ASX will need to do so before the time at which the Company’s CDIs are suspended from trading on the Official List, being the time noted in the above timetable (the “Trading Suspension Date”).

There are currently no plans for the Company to operate a share buy-back or similar facility.

If CDI holders do not sell their CDIs prior to the Trading Suspension Date, their CDIs will need to be converted to shares of common stock in the Company. Details of the process to convert CDIs to common stock are set out in more detail in the Notice of Special Meeting.

Regulation of the Company following a Delisting

As the Company is incorporated in the State of Delaware in the United States of America and not in Australia under the Corporations Act 2001 (Cth) (“Corporations Act”), it is not generally governed by the requirements of the Corporations Act but instead by local Delaware law, and when listed on the ASX, the requirements of the ASX Listing Rules.

Should a Delisting occur, the Company will operate as an unlisted incorporated corporation, governed by the requirements of the local laws of Delaware which includes the reporting requirements of the SEC’s rules and regulations pursuant to Section 13(a) of the Securities Exchange Act of 1934, as amended, together with the Company’s existing bylaws.

After the Delisting Date, the Company will no longer be subject to the ASX Listing Rules and the Company will no longer be a disclosing entity for the purposes of the Corporations Act (being a foreign entity, the Company is only required to be a disclosing entity for the purposes of the Corporations Act while it is listed on the ASX).

The Company also confirms that as it is not generally governed by the provisions of the Corporations Act, Part 2F.1 and Part 6.10 Division 2 Subdivision B of the Corporations Act, do not apply to the Company.

Update on Ongoing Funding Arrangements

As has been announced by the Company on a number of occasions, the Company will need to raise additional funds in order to continue to implement its business plan and to continue to carry on business. If the necessary funds are not raised, the Company may need to cease business operations and be wound up.

Prior to a Delisting, given the Company’s need for immediate funding, the Company may seek to issue a convertible note or a debt instrument to one or more lenders as an interim measure before seeking to secure a larger amount of equity funding, which may include the Potential Financing referred to below. There is no guarantee, however, that the Company will be able to secure any form of debt or equity funding, and as a result may be required to cease business operations and be wound up.

As previously announced, the Company is currently in confidential non-binding discussions with certain potential investors regarding an equity investment in the Company (the “Potential Financing”).

Following the occurrence of the Delisting, the Company will continue to actively seek to secure debt and/or equity funding (which may include the Potential Financing). Again, there is no guarantee that the Company will be able to secure any form of debt or equity funding and as a result may be required to cease business operations and be wound up.

Next Steps

The Company currently intends to proceed with a Delisting in accordance with the timetable above. If there is any amendment to this timetable, the Company will update the market via an ASX announcement and an SEC 8-K. The Company will also provide an update to the market should there be any material developments in relation to a material fundraising.

This announcement is being made in accordance with Rule 135c of the Securities Act of 1933, as amended, and is not intended to and does not constitute an offer to sell nor a solicitation for an offer to purchase any securities of the Company.

This announcement has been authorized for release by Charles Carter, chief financial officer and company secretary of GI Dynamics.

About GI Dynamics

GI Dynamics®, Inc. (ASX:GID) is the developer of EndoBarrier®, the first endoscopically delivered medical device for the treatment of type 2 diabetes and the reduction of obesity. EndoBarrier is not approved for sale and is limited by federal law to investigational use only. EndoBarrier is subject to an Investigational Device Exemption by the FDA in the United States and is entering concurrent pivotal trials in the United States and India.

Founded in 2003, GI Dynamics is headquartered in Boston, Massachusetts. For more information please visit the Company website at www.gidynamics.com.

Forward-Looking Statements

This announcement may contain forward-looking statements. These statements are based on management’s current estimates and expectations of future events as of the date of the press release. Furthermore, the estimates are subject to several risks and uncertainties that could cause actual results to differ materially and adversely from those indicated in or implied by such forward-looking statements.

These risks and uncertainties include, but are not limited to, risks associated with the Company’s ability to continue to operate as a going concern; the ability of the Company, its critical vendors, and key regulatory agencies to resume operational capabilities subsequent to the removal of COVID-19 pandemic restrictions; the Company’s ability to continue to operate as a going concern; the Company’s ability to raise sufficient additional funds to continue operations, including the successful closing of the contemplated financing discussed in this announcement, the related bridge loan and a delisting from the ASX, and to conduct the planned pivotal trial of EndoBarrier in the United States (STEP-1); the Company’s ability to execute STEP-1 under the FDA’s Investigational Device Exemption; the Company’s ability to enlist clinical trial sites and enroll patients in accordance with STEP-1; the risk that the FDA stops STEP-1 early as a result of the occurrence of certain safety events or does not approve an expansion of STEP-1; the Company’s ability to enroll patients in accordance with I-STEP; the Company’s ability to secure a CE Mark; the Company’s ability to maintain compliance with its obligations under its existing convertible note and warrant agreements executed with Crystal Amber, including its obligations to make payment on the convertible note that is now due on 15 June 2020 and its ability to restructure the terms of such convertible note with Crystal Amber if the Company is unable to raise sufficient funds to enable it to fully repay such convertible note when due; obtaining and maintaining regulatory approvals required to market and sell the Company’s products; the possibility that future clinical trials will not be successful or confirm earlier results; the timing and costs of clinical trials; the timing of regulatory submissions; the timing, receipt and maintenance of regulatory approvals; the timing and amount of other expenses; the timing and extent of third-party reimbursement; intellectual-property risk; risks related to excess inventory; risks related to assumptions regarding the size of the available market; the benefits of the Company’s products; product pricing; timing of product launches; future financial results; and other factors, including those described in the Company’s filings with the SEC.

Given these uncertainties, one should not place undue reliance on these forward-looking statements. The Company does not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events or otherwise, unless it is required to do so by law.

###